Your Trusted Partner for All Tax Preparation Needs

Unlock your business potential with Diligent Tax Services. Serving in the United State, we offer expert tax preparation and personalized financial solutions for business owners, entrepreneurs, and coaches.

Let us be your trusted partner in success.

Scheduling with Diligent Tax Services is simple and hassle-free.

Diligent Tax Services has been Providing Clients personalized Tax and Accounting Services throughout United State.

Trusted Financial Expertise

With years of experience serving the DFW Metroplex, Diligent Tax Services brings unparalleled expertise to tax preparation and accounting.

Personalized Solutions

At Diligent Tax Services, we know that every client’s financial situation is different. That's why we offer customized tax and accounting solutions designed to meet your specific goals.

Fast and Reliable Support

We understand the importance of timely communication when it comes to your finances. Our team prides itself on responding to inquiries within 24 hours, giving you confidence that your needs are always a priority.

Commitment to Your Success

At Diligent Tax Services, your success is our mission. Beyond tax preparation, we’re dedicated to helping you achieve financial growth and stability through expert advice and proactive support.

Financial Knowledge

Diligent Tax Services offers a full range of tax and accounting services to simplify your financial management.

Community Focus

As a trusted name in the DFW Metroplex, Diligent Tax Services understands the unique needs of local businesses and individuals. Our community-focused approach ensures that your neighbors invested in your success.

We offer expert Tax Preparation services at affordable prices with a personalized approach to meet your unique needs.

Personal Tax

Tax Return Preparation Prepare accurate Federal and State 1040 tax returns Prepare filing for Single, Head of Household, Married Filing Joint, Married Filing Separate Review client documents for accuracy (W-2, 1099, Social Security, Retirement, etc.)

Income & Document Review Analyze income sources (employment, self-employment, investments, rental, retirement) Review credits, deductions, and expenses for eligibility Assist clients in gathering all required documents

Credits & Deductions Assistance Child Tax Credit Earned Income Credit (EIC) Education Credits (AOTC, LLC) Child & Dependent Care Credit Retirement contributions Medical, dental, and itemized deductions Charitable contribution review

Self-Employment / Schedule C Support Profit & loss review Expense categorization Mileage and business-use-of-home calculations 1099-NEC and gig-worker income review

IRS & Compliance Assistance Help clients understand IRS notices Assistance with Identity Protection PIN (IP PIN) Correcting and amending returns (Form 1040-X) Year-round tax support and guidance

Electronic Filing (E-File) Secure e-file submission Tracking and confirming return acceptance Provide refund status guidance

Tax Planning Review ways to reduce tax liability Give recommendations for withholdings for next year Assist with estimated tax payments Advise on life changes (marriage, dependents, home purchase, education, etc.)

Customer Support Provide clear explanations of all tax options Answer questions related to credits, deductions, dependents, and refund timing Offer easy communication and document upload options Provide receipts, summaries, and copies of filed returns

Business Tax

Full Schedule C Preparation

Prepare federal and state business tax returns Accurately report income from 1099-NEC, 1099-K, cash app, PayPal, Zelle, and cash payments Prepare returns for sole proprietors, independent contractors, and gig workers

Income & Expense Review

Organize and categorize business expenses Review receipts, statements, and bookkeeping records Profit & Loss (P&L) creation and cleanup Help clients identify tax-deductible expenses

Business Deductions & Credits

Home office deduction Mileage and vehicle expense calculations Supplies, tools, equipment, advertising, and software expenses Phone and internet business-use calculations Depreciation of business assets (if applicable) Self-employment health insurance deduction Retirement plan contributions (SEP IRA, Solo 401k)

Tax Compliance & IRS Support

Help resolve IRS letters and notices Assist with IRS Identity Protection PIN (IP PIN) Amended returns for business corrections (1040-X + Schedule C) Guidance on estimated tax payments to avoid penalties Review quarterly payments and set up a payment plan if needed

Bookkeeping Support

Annual bookkeeping review Help clients organize income and expenses for tax filing Setup or cleanup of simple business records

Business Structure Guidance (Non-Legal)

Explain tax differences between Sole Prop, LLC, and S-Corp Advise when it may be beneficial to change tax status Provide general guidance for new business setup (EIN, recordkeeping, etc.)

E-File & Documentation

Secure electronic filing for all business-related tax forms Provide tax summaries, receipts, and copies of filed returns

Year-Round Business Tax Planning

Strategies to lower business tax liability Guidance on business growth, income planning, and deductions Assistance with budgeting for taxes and quarterly payments

And More.....

About Me

Since 2011, I have proudly served as a tax professional and the Owner & CEO of Diligent Tax Services. I am an IRS-Certified Tax Preparer and an Enrolled Agent (E.A.), authorized to represent clients before the Internal Revenue Service in audits, collections, and appeals. My practice is built on integrity, accuracy, and a strong commitment to helping individuals, families, and business owners achieve financial stability and confidence. I specialize in preparing accurate tax returns, reducing tax liabilities where legally appropriate, resolving complex tax matters, and providing clear, reliable guidance in an often confusing area of finance. Through continuous education and staying current with changing tax laws, I ensure my clients receive knowledgeable, ethical, and professional service they can trust.

Tarence Robinson

CEO & Manager,

Diligent Tax Services

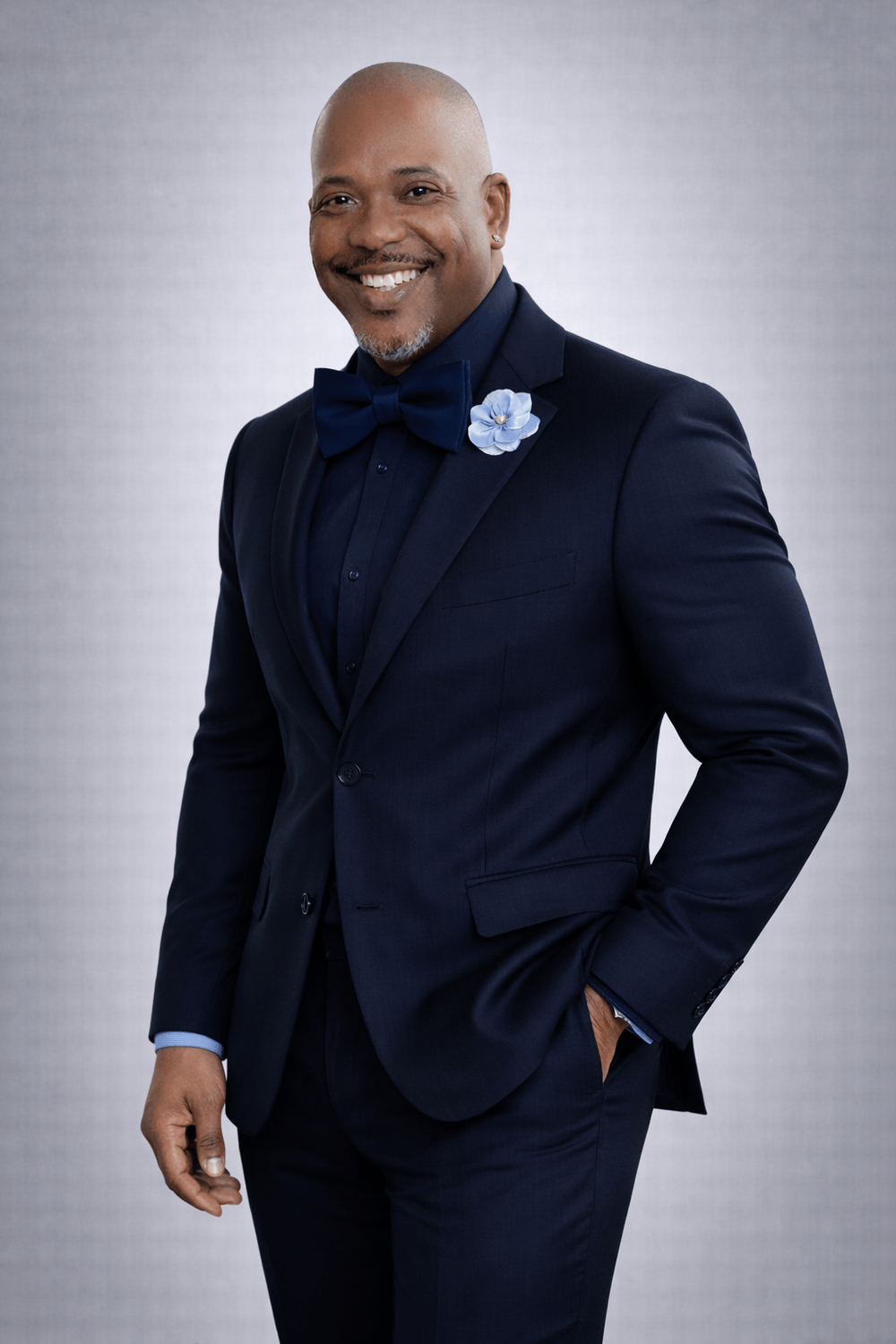

Hear From Our Clients

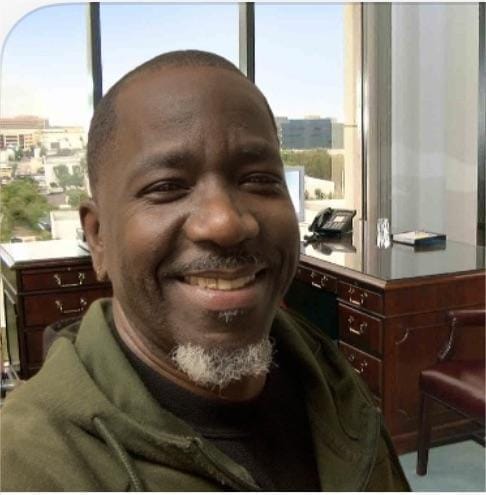

Victor Robinson joined Diligent Tax Services in 2014 and dedicated himself wholeheartedly to his work as a tax preparer. Throughout his years with us, Victor exemplified professionalism, diligence, and a genuine care for every client he served. His commitment to helping individuals and businesses navigate their taxes with confidence and accuracy was truly remarkable. Victor’s hard work, dedication, and positive spirit left a lasting impact on our team and the clients he assisted. He consistently went above and beyond, always willing to lend his knowledge and support wherever it was needed. His contributions helped shape Diligent Tax Services' success, and his presence brought warmth and encouragement to everyone around him. He will be deeply missed, but we find comfort knowing he is now at peace with his Heavenly Father. Victor Robinson’s legacy of service, integrity, and kindness will always be remembered and cherished by all of us at Diligent Tax Services.

Rest in Heaven, Victor. You will never be forgotten.

No Cost Advanced Loans from $250 up to $7,000 Apply Today

We will not send spam messages

GET IN TOUCH

Contact Us

Adress 610 Uptown Blvd Suite #2000 Cedar Hill, TX 75104

Virtual Appt